It’s not a secret that women and diverse-owned firms are underrepresented in investment management. According to recent research released by the Knight Foundation, of the $82 trillion in the U.S.- based asset management industry, only 1.4% of assets under management are managed by firms owned by women or people of color.

Diverse-owned alternative asset management firms face all of the same challenges their non-diverse competitors face. But in addition to contending with market or economic conditions and sourcing the next alpha-generating investment, they face a host of unsubstantiated misconceptions. Investing acumen, the ability to drive strong returns, education and big-firm experience are often unjustly called into question.

Much of NAIC’s work focuses on debunking these myths and showing that when a diverse-owned firm outperforms, its team is not the outlier but rather the norm and the result of a proven investment thesis, strong track record and high-quality management experience. With that in mind, let’s look at the most common myths that have stigmatized diverse alternative asset managers and provide a healthy dose of truth and accuracy to debunk those mistaken beliefs.

MYTH #1: DIVERSITY COMES AT A COST TO PERFORMANCE

Perhaps the most common misconception throughout the industry is that including diverse managers in institutional portfolios is antithetical to superior returns. The truth is that fiduciary responsibilities mandate that investment officers and consultants cast a wide net in their searches for asset management services and allocate a portion of assets to those who produce outsized returns. NAIC’s Examining the Returns Performance Study serves as an important resource to educate the industry about the talent and returns generated by diverse asset managers as we advocate for greater capital allocations.

Perhaps the most common misconception throughout the industry is that including diverse managers in institutional portfolios is antithetical to superior returns. The truth is that fiduciary responsibilities mandate that investment officers and consultants cast a wide net in their searches for asset management services and allocate a portion of assets to those who produce outsized returns. NAIC’s Examining the Returns Performance Study serves as an important resource to educate the industry about the talent and returns generated by diverse asset managers as we advocate for greater capital allocations.

The report also underscores the simple truth that inclusion and outperformance often go hand-in-hand. Among its findings: diverse managers beat their benchmarks, including the Burgiss median, for net IRR, MOIC and DPI from 1998 to 2020 and from 2011 to 2020. In addition, they posted higher net multiples on invested capital than the median Burgiss private equity fund.

Another recent study, the Knight Foundation’s 2021 Diversity of Asset Managers Research Series, reported that across all asset classes, non-diverse firms do not outperform diverse-owned firms.

MYTH #2: DIVERSE MANAGERS ARE THE SAME AS SMALL AND EMERGING MANAGERS

The terms “diverse manager”and “small/emerging manager”are often used interchangeably. While the two categories overlap, they are not entirely synonymous. Diverse managers are firms owned by women or people of color who are traditionally underrepresented in the asset management industry. However, not all of them can be categorized as “small”and range across all AUM sizes, breadth of experiences, investment track record, and more. In fact, NAIC membership includes several diverse firms that oversee more than $1 billion in AUM and a few that manage more than $10 billion.

MYTH #3: DIVERSE MANAGERS ARE HARD TO FIND

Decision-makers at institutional investment plans and their consultants sometimes gravitate to the same big-name firms, incorrectly assuming it’s too challenging to identify high-performing diverse asset managers. The number of diverse-owned firms has increased significantly in the last decade, making it easier for capital allocators to integrate diverse managers into their portfolios. A recent Fairview Capital Partners study, “Women and Minority-Owned Private Equity and Venture Capital Firms,” reports that the universe of women and diverse-owned firms has grown 6x in the past 7 years. In addition, GCM Grosvenor, another leading fund of funds, reports having an active universe of more than 775 women- and minority-led private equity firms with investments spanning all industries and strategies.

NAIC has an ever-growing membership of more than 160 diverse-owned firms across Private Equity (Buyout, Growth & Expansion, Venture Capital), Private Credit, Hedge Funds, Real Estate, and Fund of Funds. NAIC programs provide frequent opportunities to connect high-performing member firms with capital allocators.

MYTH #4: DIVERSE MANAGERS EXCLUSIVELY INVEST IN DIVERSE ENTREPRENEURS

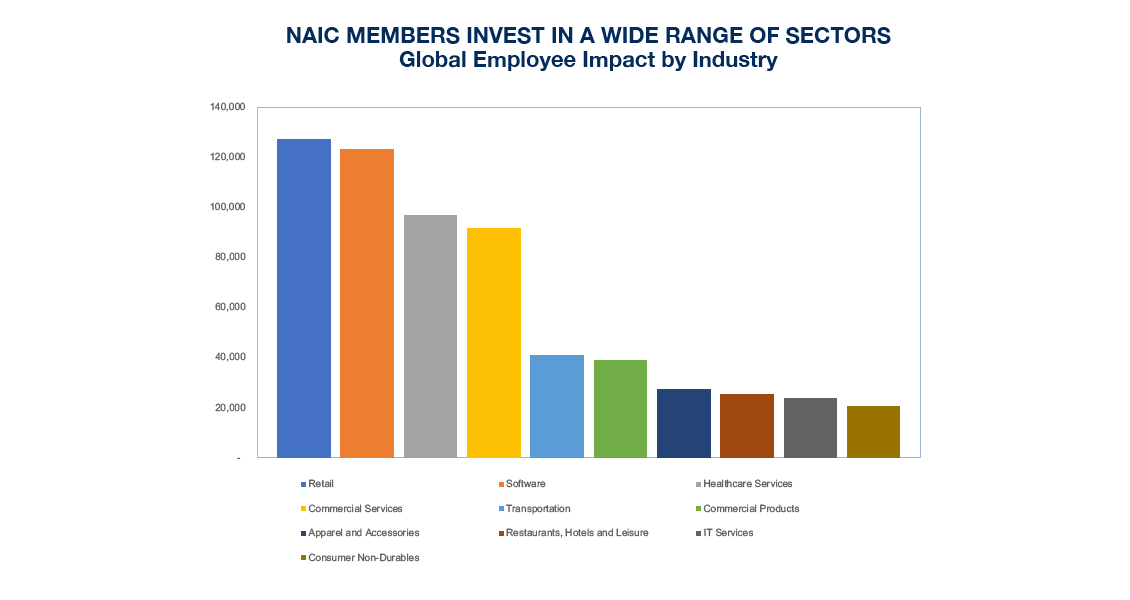

While some NAIC member firms focus on providing capital to diverse entrepreneurs and investing in communities of color, the overwhelming majority are founder agnostic. NAIC firms seek targets with operational and market upside to return value to their investors in a wide range of industry sectors that include healthcare, communications, technology, real estate, retail, software and more. NAIC private equity members alone are invested in over 1,293 portfolio companies and many have invested in companies that are now well known. Among them are digital food ordering and delivery platform Grubhub Inc., SaaS technology provider Cvent, space transportation services provider SpaceX, office supply chain Staples and mobility as a service provider Uber Technologies, Inc.

MYTH #5: DIVERSE MANAGERS LACK EXPERIENCE AND EXPERTISE

Most diverse managers have graduated from the same venerable universities and gained experience at the same leading investment firms as their non-diverse counterparts. These diverse investors often gained experience from leading global firms that include Goldman Sachs, The Carlyle Group, Ripplewood, Credit Suisse and Deutsche Bank, to name a few. Many eventually took the entrepreneurial route and spun-out their investment strategies from these industry stalwarts to launch their firms with experienced teams and track records intact.

MYTH #6: EMPLOYEE RETIREMENT INCOME SECURITY ACT (ERISA) RESTRICTS CONSIDERING RACIAL, ETHNIC, AND GENDER DIVERSITY

Quite the opposite is the reality. There are greater calls for transparency and higher levels of inclusion in asset manager selection. The Department of Labor (DOL) guidelines issued in October 2015 clarify that environmental, social, and governance (ESG) factors “may have a direct relationship to the economic value of investments’ and therefore may be considered in a fiduciary’s primary economic analysis of plan investments.”

However, though many institutional investors now identify prioritizing diversity in investing as a goal, they don’t necessarily pursue that goal in meaningful and tangible ways. A recent Morgan Stanley survey, Asset Owners and Investing in Diversity: Intention versus Action, reported that the industry can look to public pensions for evidence of impact and inspiration for how to diversify managers.

One example is the New York City Public Pension Funds, which require all prospective managers in private and public markets that undergo due diligence to complete a Diversity Profile and answer diversity and MWBE-related questions in the Due Diligence Questionnaire. Further, the $481.2 billion California Public Employees’ Retirement System, Sacramento, and the $318.4 billion California State Teachers’ Retirement System, West Sacramento, will be required to submit an annual report on the status of certain objectives and initiatives regarding their investments with emerging or diverse money managers beginning on March 1, 2023.

These and other misconceptions are major contributors to the massive disparity between assets managed by diverse and non-diverse investment professionals. However, increased calls for institutional retirement plans to practice transparency and inclusive practices and NAIC’s advocacy and programs to educate the marketplace on the talent within the diverse alternative asset management industry should increase allocations to these high-performing managers.