This year has been one of unprecedented growth for NAIC on all fronts. Our membership, sponsors, partnerships, and programs have all grown meaningfully. NAIC would like to take a moment to thank everyone in our network – which stands larger and stronger than ever before.

NAIC welcomed an astounding 57 new member firms in 2022, and our membership now stands at 187 firms that collectively manage more than $310 billion in assets. Despite a less-than-ideal economic environment, our member firms closed on oversubscribed funds and completed alpha-generating exits and landmark acquisitions.

More than 50 years ago, NAIC planted its flag in the diverse alternative asset management space. We have since evolved into the premier source for information and data related to diversity in the alternative investment industry. Additionally, we have set the pace in regard to tackling diversity issues in the asset management industry.

Before we wrap up 2022, we’d like to look back at some of the accomplishments that made this year a resounding success for NAIC and our network.

Membership Grew by 30%

NAIC’s member firms are the lifeblood of the organization. Every project we undertake and every initiative we launch is done so with these firms in mind. So, when we experience year-over-year growth in membership, it’s like getting an A+ on our report card.

We are happy to report that NAIC is finishing 2022 with 187 members – a 30% increase over 2021! These firms represent the full spectrum of the alternative investment industry with investment strategies ranging from Private Equity (Growth and Buyout), Venture Capital, Private Credit, Hedge Funds, Real Estate, Fund of Funds, and more.

Our member firm portfolio companies collectively employ more than 600,000 individuals.

Connecting LPs with Members at Institutional Investor Roadshows

At the core of NAIC’s mission is to drive greater capital allocations to high-performing diverse-owned firms. Our Roadshows offer a platform where diverse managers can meet privately with leaders of major institutional investment plans. In 2022, NAIC curated 330 one-on-one virtual meetings between member firms and leading capital allocators at 10 Roadshows.

Special thanks to the capital allocators and organizations that hosted our 2022 Roadshows:

- Office of the NYC Comptroller

- National Conference on Public Employee Retirement Systems (NCPERS)

- Mercer (2 Roadshows)

- CalSTRS

- Los Angeles County Employee Retirement Association (LACERA)

- BlackRock

- Institutional Limited Partners Association (ILPA) (2 Roadshows)

- Rockefeller Capital Management

Leveled Up Our LP Meetup

Our flagship event, the LP Meetup, continues to set the industry standard for facilitating meaningful interactions between leading LPs and diverse-owned asset management firms. The LP Meetup has grown yearly – in both participating capital allocators and asset managers – and 2022 continued the trend.

During our largest LP Meetup to date, we coordinated more than 340 custom-curated meetings between NAIC member firms and 80+ institutional investor decision-makers.

Celebrated the NAIC Network with a Midsummer VIP Reception

NAIC hosted a Midsummer VIP Reception in July to show appreciation for our strong network, valued partners and other supporters. Held at New York City’s elegant Gotham Hall ballroom, the sold-out event included more than 120 member firms, 40 capital allocators and partnership champions from NAIC’s eight Corporate Partners, who networked and celebrated the successes within the diverse asset management industry.

The event’s honorary co-chairs, who support our mission to increase the capital flow to high performing diverse-owned managers, included: Peter Ammon, CIO, University of Pennsylvania Endowment; Shoiab Khan, Director and CIO, NJ Division of Investment; Brad Lander, New York City Comptroller, Office of NY Comptroller; Kim Lew, President & CEO, Columbia Investment Management Company; O’Kelly E. McWilliams III, Chairman of the Board of Trustees, Virginia Retirement System; Anastasia Titarchuk, CIO, NY State Common Retirement Fund; and Michael Trotsky, Executive Director & CIO, Massachusetts Pension Reserves Investment Trust (MassPrim).

NAIC Published 2 Insightful Reports

NAIC-AIC Innovation Report

Private equity’s position in the innovation economy was considered “new”for many years. Today, firms such as Silver Lake, Vista, and Thoma Bravo are considered some of the most sophisticated minds in technology, maintaining America’s lead in the global innovation economy, helping reinvigorate and scale dozens of companies under their lead, and adding jobs to thousands of innovating companies all around the country.

NAIC-AIC Infrastructure Report

Some of the brightest minds in infrastructure work in specialized private equity firms that invest in long-term, complex projects—investments that often span a decade or more. In some cases, PE firms can help local and state governments that are facing budget shortfalls. In recent years, PE firms have financed cell towers, wastewater management systems, and even entire airports. Infrastructure investing requires regulatory know-how, precise planning, and lots of capital. Today’s PE firms have all three.

Innovative Partnerships that Create Unique Value for our Members

Our Corporate Partners understand the value of interfacing with the diverse marketplace. These synergistic relationships fuel NAIC’s programs and initiatives while providing these industry leaders with direct access to a robust and highly engaged community of asset managers and institutional investors that comprise the NAIC ecosystem.

This year we welcomed Amazon Web Services (AWS), the world’s most comprehensive and broadly adopted cloud platform, as a Multi-Year Corporate Partner. AWS joins 7 other valued Multi-Year Corporate Partners: BlackRock, EY, Goldman Sachs, Korn Ferry, Lockton, TPG, and William Blair. We are grateful to these industry-leading companies who help us advance our mission of helping diverse-owned firms succeed.

Our partnership with Amazon Web Services (AWS) was created to facilitate an increased flow of information and resources between the leading technology solutions provider and diverse investment managers. We co-hosted two virtual member events to highlight the solutions AWS offered to enhance cloud security and create portfolio value. In addition, we developed a series of NAIC Perspectives videos featuring Paul Zimmerman to share AWS thought leadership and share important technology trends.

Expanded Sponsorships

Our lineup of industry-leading programs and initiatives would not be possible without the support of our sponsors. These organizations and their respective leaders understand the value of creating an inclusive industry and the alpha diverse-led firms generate. We would like to thank our Premier Sponsors, Grain Management, IMB Partners, Investcorp, Palladium Equity Partners, Valor Equity Partners, Vista Equity Partners, and Wells Fargo for their generous support.

In 2022, we announced a new Premier Sponsorship with multinational investment bank and financial services provider UBS. This relationship will focus on increasing UBS’ access to diverse alternative investment managers and broadening the diverse talent pipeline into the industry. UBS will support NAIC’s 2023 Institutional Investor Roadshows, LP Meetup, and Women in Alternatives initiative.

Strengthened Ties with Alliance Organizations

Industry organizations that support our mission to increase diversity in the industry continue to be valued allies. We are proud to count American Investment Council (AIC), the Diverse Asset Managers Initiative (DAMI), Institutional Limited Partners Association (ILPA), National Conference on Public Employee Retirement Systems (NCPERS) and the Pacific Pension & Investment Institute (PPI) among our valued allies.

NCPERS and ILPA participated in NAIC Institutional Investor Roadshows, which brought NCPERS’s network of approximately 500 funds and more than $4 trillion in pension assets and ILPA’s ecosystem of more than 600 member institutions representing over $2 trillion to NAIC member firms.

In September, NAIC hosted a welcome reception in partnership with AIC to kick off the Congressional Black Caucus Foundation’s 51st Annual Legislative Conference. The reception featured a fireside chat with Drew Maloney, CEO of AIC, our CEO, Robert L. Greene, and Rep. Gregory Meeks (D-NY), Chairman of the CBC.

Our CEO also joined Pacific Pension & Investment Institute (PPI) President, Lionel C. Johnson, to host “Diversity, Equity, and Inclusion: More than the ‘S’ in ESG.” This videoconference allowed NAIC member firms to engage with more than 30 LPs in PPI’s network. Greene also led a luncheon panel discussion titled “Debunking the Myths Regarding the Performance of Diverse Managers”at the National Conference on Public Employee Retirement Systems (NCPERS) Annual Conference and Exhibition.

Positioned More Diverse-Owned Investment Firms for Success with an Enhanced NextGen Symposium

In 2022, we expanded the content for NextGen Symposium, our industry-leading series of intensive virtual training sessions designed to educate and empower a new generation of female and ethnically diverse firm founders. Nine weekly sessions included 16 comprehensive modules that were led by instructors representing the best of class in alternative investing. Module leaders included founders who have successfully launched firms and raised capital, leading capital allocators, and executives from law firms and other service providers who assist new firms in getting started.

Registration is now open for our 2023 NextGen Symposium.

Expanded the Talent Pipeline Through Women in Alternatives Initiatives

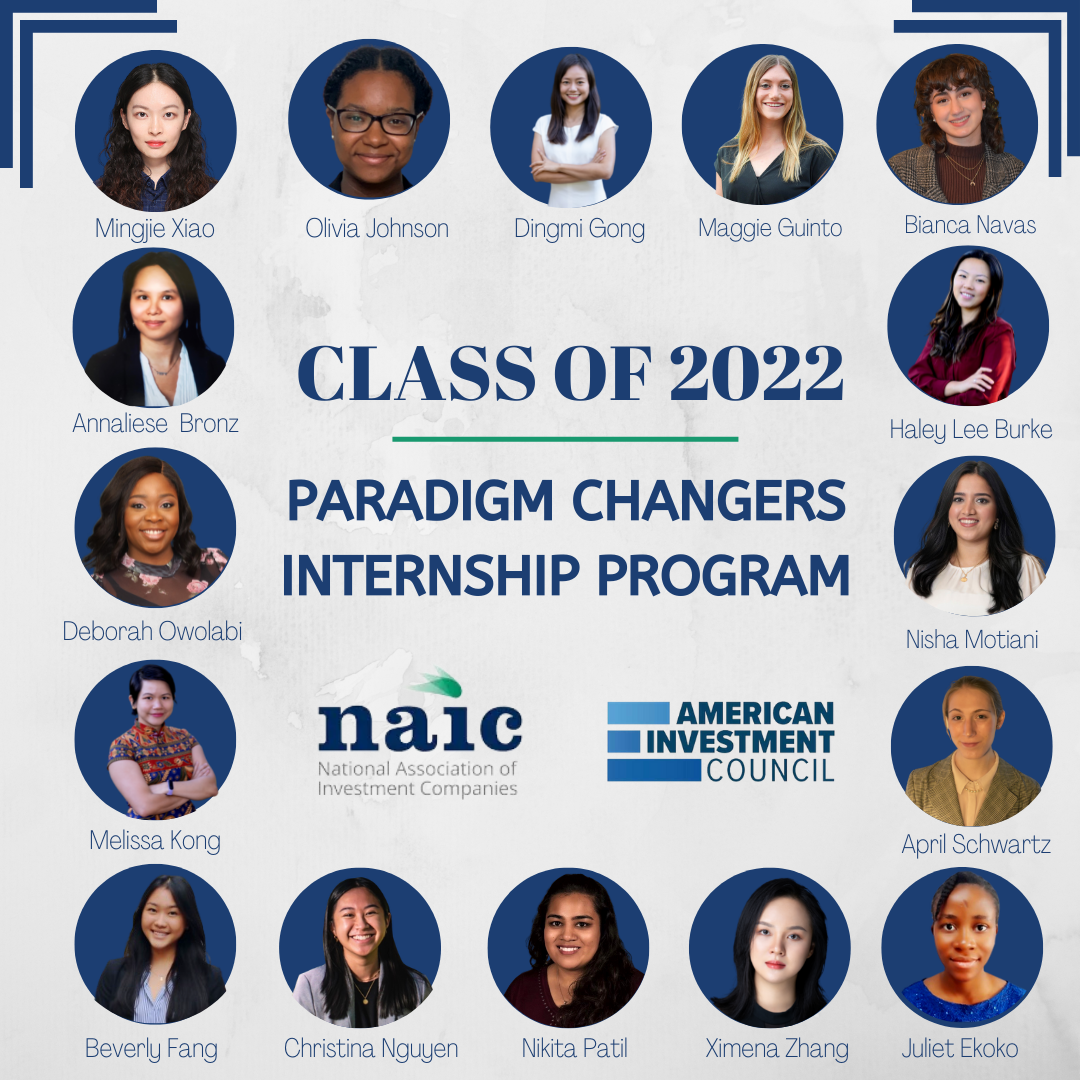

NAIC’s PARADIGM CHANGERS Internship Program provides female undergraduate and graduate students from a broad array of academic disciplines the necessary tools to lead and succeed in alternatives. The program includes training, career development programming, mentoring, and summer internships at leading NAIC and American Investment Council (AIC) member firms.

In 2022 we welcomed 17 PARADIGM CHANGERS interns. Special thanks go to the firms that hosted 2022 PARADIGM CHANGERS interns: ACON Investments, Advent International, American Investment Council, Apollo Global Management, Avance Investment Management, Avante Capital Partners, Avenue Growth Partners, Brasa Capital Management, Commonfund, Corsair Capital, GCM Grosvenor, GenNx360, Lumos Capital, Palladium, Sixth Street, The Riverside Company, and TPG.

We launched the UP Fellowship Program in 2022 with 8 ethnically diverse women in the mid-phase of their careers in alternative investments. The 8 UP Fellows were paired with senior female leaders in the alternatives space for a 9-month mentorship program from January to September. UP Fellows also attended monthly professional development workshops.

Thank you to our Women in Alternatives sponsors, who make these programs possible: American Investment Council, IMB Partners, Palladium Equity Partners, TPG, and UBS.

Shared Perspectives from Industry Leaders Through Our Industry Insights Series

We welcomed an outstanding lineup of 10 industry-leading investors, entrepreneurs, and executives this year for intimate conversations as part of the NAIC Industry Insights Series. These virtual conversations provided timely and relevant insights into the strategies, investments, perspectives and future plans of industry leaders and prominent investors.

Special thanks to these distinguished leaders who participated in our 2022 slate of Industry Insights conversations:

- Margaret Anadu, Global Head of Sustainability and Impact, Goldman Sachs Asset Management

- Ying McGuire, NMSDC CEO & President

- Tammy K. Jones, Co-Founder & CEO, Basis Investment Group

- Robert Raben, Executive Director, Diverse Asset Managers Initiative

- José E. Feliciano, Co-founder & Managing Partner, Clearlake Capital Group

- Sam Johnson, Americas Vice Chair, Markets & Accounts, Ernst & Young LLP

- Martin Nesbitt, Co-Founder and Co-CEO, The Vistria Group

- Stephanie Smith, Managing Director and Chief Operating Officer of BlackRock Alternative Investors (BAI)

- David Clunie, Executive Director of the Black Economic Alliance (BEA)

- Michael C. Hyter, President and CEO of The Executive Leadership Council (ELC)

Be sure to visit NAIC’s YouTube channel if you missed any of these engaging conversations.

Expanded the NAIC Team

NAIC’s robust suite of programs and initiatives continues to expand in scale and scope as we strengthen our leadership position in the alternative asset management space. To support our evolution as an organization, NAIC added two new team members: Kristen Perlman, Director of Marketing & Communications, and Jennifer Moore, Executive Assistant. In addition, Dawn Simmons was promoted to Member Services Coordinator in 2022.

Positioned Future Industry Leaders for Success with NAIC MBA Fellowship

NAIC established the MBA Fellowship Program in 2019 to create a robust pipeline of diverse talent in the industry. Now in its 4th year, the program provides diverse MBA students with opportunities to work side-by-side with leaders in the alternative asset management industry – gaining invaluable experience and networking opportunities in the process.

The 2022-23 cohort represents talented MBA candidates that will become the next generation of industry leaders: Afua Asantewaa (Harvard Business School), Nia Johnson (Columbia Business School), Adam Lawal (UPenn Wharton School), Eliana Lozano (University of Michigan Stephen M. Ross School of Business), and Inés Valenzuela (UPenn Wharton School).

Thanks to NAIC member firms Valor Equity Partners, Stellex Capital Management, Palladium Equity Partners, LLC, and Grain Management, LLC, for endowing our five 2022-2023 Fellows.

A Look Ahead: 2023 Sneak Peek

Every year the NAIC team assesses which programs should be expanded and what new initiatives are required to help advance our mission. We’re looking forward to hitting the ground running in 2023 when we will launch Convergence: Where Diverse Talent and Private Equity Opportunities Meet. This new initiative will create a talent bank to match diverse talent with opportunities at our member firms, including their boards and portfolio companies.

We will also unveil a new-and-improved website in 2023. The new site will feature improved functionality and navigation, as well as an enhanced Member Portal with additional resources and tools for our members.

Next year will also bring an expansion of the Women in Alternatives: In, Up and Beyond initiative, as we will be launching the BEYOND portion, which will help women in leadership positions prepare to start their own alternative investment firms.

There are other new initiatives in the pipeline, so look for new staff announcements next year as we continue to grow the necessary resources to support our programs and members.

Happy Holidays!

Finally, on behalf of the NAIC Board of Directors and Staff, we wish you all a safe and happy holiday season. We truly appreciate our network and the dedication of everyone within it. It is the commitment of our member firms, industry alliances, corporate partners, sponsors, participating institutional investors, and our community as a whole that enables the work of NAIC. Because of all of you, we are able to drive forward our efforts to reshape the alternative asset management industry toward a better, more equitable and inclusive reality.

Enjoy the season, and we will see all of you in the new year!

Best regards,

Joseph J. Haslip

Chairman of the Board

Robert L. Greene

President & CEO