-

Why Invest with Diverse Managers?

-

Our Members

-

Partnerships & Alliances

-

Experience NAIC

- Upcoming Events

- News & Insights

-

About Us

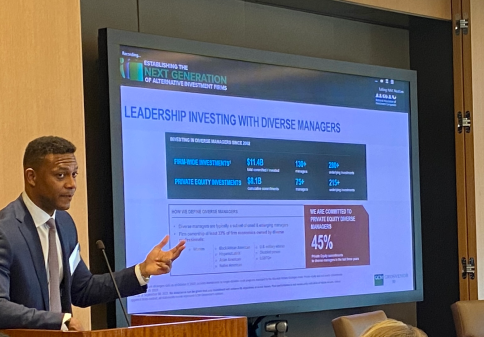

Debunking the Myths

Diverse-owned alternative investment management firms face a host of unsubstantiated misconceptions. Learn the truth based on facts and research.

Member Data

A deep look at NAIC’s member firms provides compelling evidence for investing with diverse managers. IntelligentNAIC aggregates member firm information to deliver proprietary diverse-manager research.

Industry Research

View curated studies in support of investing with diverse managers produced by leading third-party entities.

Member List

View NAIC’s member firms, categorized by investment strategy.

Member Data

A deep look at NAIC’s member firms provides compelling evidence for investing with diverse managers. IntelligentNAIC aggregates member firm information to deliver proprietary diverse-manager research.

Member Benefits

Learn why NAIC has become the largest network of diverse-owned alternative investment firms and why our membership continues to grow. Our vast array of programs and initiatives support firms in all stages and strategies.

Become a Member

Reach out to join NAIC’s growing network of diverse-owned firms and industry leaders.

Multi-Year Partnerships

Our multi-year corporate partners have demonstrated a commitment to supporting our member firms. Learn how we work with them to develop customized programs to optimize impact and exposure.

Sponsorships

Sponsors play a vital role in NAIC’s success, supporting one or more of our programs and events. Learn how sponsors elevate NAIC’s mission.

Industry Alliances

NAIC is proud to have alliances with many of the largest and most influential institutional investor organizations. Learn more about these organizations that participate in our programs and events.

Overview

Explore the ways you can engage with NAIC. Learn about our programs and initiatives that connect diverse investment managers and capital allocators; develop skills and competencies; provide data and insights; and propel diverse careers. We offer events, programs, tools and reports, all in support of our mission: to increase the flow of capital to successful diverse alternative asset managers.

NAIC Access

Experience programs and initiatives that connect diverse-owned alternative investment firms and capital allocators.

- Amplifying Alts Forum

- Fundraising Advisory Support Tracker (FAST)

- Institutional Investor Roadshows

- Managers in the Market (MINT) Report

NAIC Academy

Experience programs and initiatives that develop skills and competencies to succeed in the alternative investment industry.

- ENGAGE Trustee Education

- NAIC Insights Series

- NextGen Symposium

NAIC Advocacy

Experience programs and initiatives that provide data and insights that support investing with diverse-owned investment managers.

- Federal Pension Initiative

- IntelligentNAIC Member Data

- Market Update Videos

- Performance Report: Examining the Returns

- Perspectives Video Series

- Thought Leadership

- MBE Certification Program

NAIC Advancement

Experience programs and initiatives that propel the careers of diverse professionals.

- Career Opportunities

- MBA Fellowship Program

- Women in Alternatives (WIA)

- WIA - UP: Fellowship Program

- WIA - BEYOND: Training for General Partners

About NAIC

Read about NAIC’s history and mission, and our journey to becoming the largest network of diverse-owned alternative investment firms.

Leadership Team

Meet the NAIC leadership, staff, and Board of Directors.