WALTHAM, MA and GAINESVILLE, FL – June 22, 2021 – Constant Contact, an established leader in online marketing, backed by Clearlake Capital Group, L.P. (together with its affiliates, “Clearlake”) and Siris Capital (together with its affiliates, “Siris”), today announced it has signed a definitive agreement to acquire SharpSpring, Inc. (“SharpSpring”) (NASDAQ: SHSP) in an all cash transaction valued at approximately $240 million including outstanding indebtedness.

Under the terms of the agreement, which has been unanimously approved by the members of SharpSpring’s Board of Directors, Constant Contact will acquire all the outstanding common stock of SharpSpring for $17.10 per share in cash. The purchase price represents a 21% premium over SharpSpring’s closing share price of $14.11 as of June 21, 2021. The transaction is expected to close in the third quarter of 2021 subject to customary closing conditions including a SharpSpring stockholder approval.

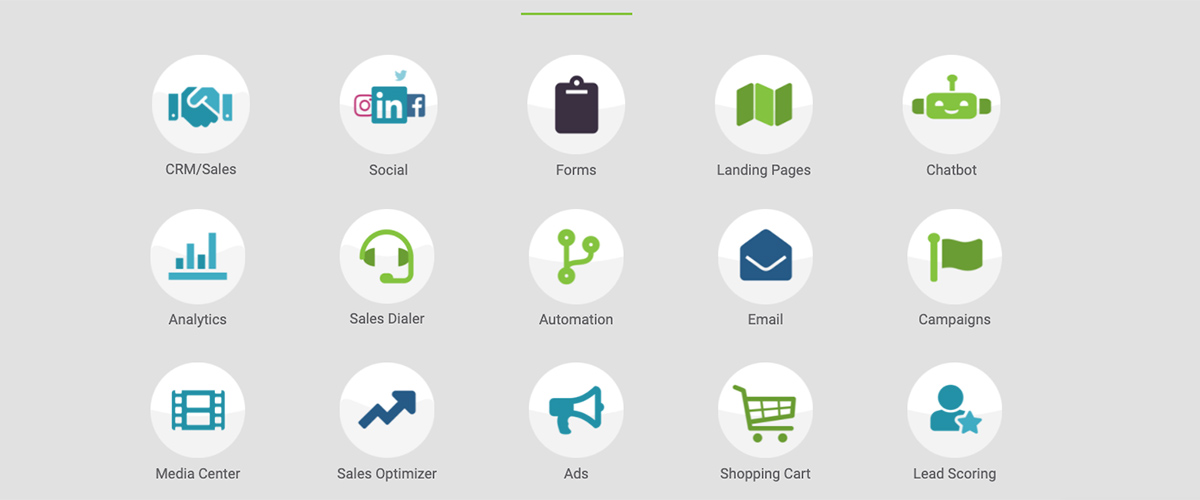

SharpSpring is a cloud-based revenue growth and marketing automation platform that improves the effectiveness of small business’s (SMBs) marketing strategy. Designed for SMBs, and often delivered by digital marketing agencies, SharpSpring generates leads, improves conversions to sales, and drives higher returns on marketing investments. The integration of SharpSpring will give Constant Contact’s SMB clients the ability to easily and successfully engage customers throughout their journey, helping clients deliver better marketing-driven results.

“Constant Contact and SharpSpring share a mission to help small businesses succeed, and this acquisition represents a powerful opportunity to combine our best-in-class email and ecommerce offerings with SharpSpring’s strong suite of revenue growth and marketing automation tools,”said Frank Vella, CEO, Constant Contact. “Today’s Constant Contact retains the customer-first culture that defined our heritage, and I am excited to expand upon that with a commitment to innovation that will accelerate our growth and build upon the passion and agility that has made our brand a leader in digital marketing for so many years.”

“SharpSpring delivers a highly innovative and feature-rich suite of marketing automation software tools. We welcome the company’s talented workforce to Constant Contact and look forward to a long partnership,”said James Pade, Partner, Clearlake, and Tyler Sipprelle, Managing Director, Siris. “This investment augments Constant Contact’s digital marketing software platform by significantly accelerating its product roadmap and enhancing the tools we offer modern-day marketers in their pursuit of key revenue generating activities.”

“Today is a great day for SharpSpring and our stockholders as this transaction brings immediate and certain value at an attractive premium,”said Rick Carlson, CEO, SharpSpring. “Today is also a great day for our team and our customers, as we partner with a scale platform that brings significant added resources as we strive to deliver even greater value to SMBs. Constant Contact is the authority on digital marketing for small businesses. I am thrilled with the opportunity to bring SharpSpring’s revenue growth platform to Constant Contact’s nearly 500,000 small business customers while also further investing in and building upon SharpSpring’s strong customer and digital marketing agency base.”

For more information regarding the terms and conditions contained in the definitive agreement, please see SharpSpring’s Current Report on Form 8-K, which will be filed in connection with this transaction.

JMP Securities LLC is acting as exclusive financial advisor and Godfrey & Kahn, S.C. is acting as legal counsel to SharpSpring, Inc. Lazard is acting as financial advisor to Constant Contact and Sidley Austin LLP is acting as legal counsel to Constant Contact.