Stephanie Braming, CFA, Partner, Global Head of Investment Management, William Blair

What drives great decision-making-and how do we improve our probability of success?

The answer will vary widely depending on the topic-investing, strategic decision-making, or even personal life choices. But I like to think that avidly investigating a topic then making a decision with about 85% of the information-while making necessary adjustments along the way-are hallmarks of great decision-making.

But what happens if that isn’t the case? What happens if, despite your best intentions, you are a prisoner to your own “mind-forged manacles,”as William Blake referred to them in his poem “London”?

Too often, we as individuals have blind spots. We are each a product of our life experience, our academic background, our current environment, and our own personal and professional preferences and biases. This shapes who we are as individuals, as colleagues, and as investors.

Diversity Bonus

While individually we strive to be creative, explore the unknown, and connect the dots, doing so requires elastic thinking, consistently searching for the unobvious, and critically reflecting on our beliefs. And while we all must be curious enough to ask “what if?”and to shift our perspectives, we must also seek out diverse inputs, thoughts, and experiences. These voices, together, can improve decision-making and success.

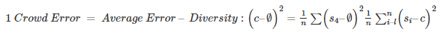

This “diversity bonus,”as Scott Page describes in his book of the same name, can actually be quantified mathematically.1

But whether measuring diversity quantitatively or sensing it through an organization’s culture, it does make a difference. I feel it in my teams at William Blair, where there is diversity of thought, roles, and experiences. Cross-sectional working groups collaborate on key issues affecting our investment outlook, industry, and company.

It takes time to connect with individuals who have different perspectives and experiences around a cohesive purpose, but I’ve found that the solutions these teams develop are that much more robust.

Philip Tetlock and Dan Gardner also highlight the benefits of diversity in their book, Superforecasting: The Art and Science of Prediction, asserting that “aggregating different views is difficult for one person. That’s why different perspectives are important.”

More Robust Decision-Making

It surprises me that the asset-management industry has not more actively embraced diverse thought, and the gender imbalance in senior ranks is still as significant as it is. But William Blair, too, is early in its journey.

We are creative in our recruiting, in our networking, and in our collaboration with external partners and organizations as we seek to develop talent in the investment arena as well as in key infrastructure roles. These efforts are meant to broaden the universe-not to subscribe to any quota or target.

While we have made good progress, over time we will continue to broaden and deepen our talent pool. I strongly believe it will lead to more robust decision-making within our investment-led culture and, in the end, better client outcomes.